Here I will be giving you details on How to Apply for the Farm Bureau Member Rewards MasterCard. Are you a member of the Farm Bureau? Well, if you are, then the Farm Bureau member rewards Mastercard has been built just for you.

As a Farm Bureau member, you get to earn double points for every dollar spent on Farm Bureau insurance premiums and/or member dues. You also have no annual fee and a standard reward program of 1 point per dollar spent.

The APR interest rate also goes as low as 10.24%, depending on your creditworthiness. Below, you will find a short tutorial that details the required steps and details needed to apply for the Farm Bureau Member Rewards MasterCard.

Farm Bureau Member Rewards MasterCard Requirements

For you to be eligible for the Farm Bureau Member Rewards Mastercard, you would have to fulfill the following requirements:

- You must be a citizen of the United States

- Must have a valid US address

- Expected to have a Valid SSN

- Must be at least 18 years of age.

How to Apply for the Farm Bureau Member Rewards MasterCard

To apply for the Farm Bureau Member Rewards MasterCard, follow the steps outlined below:

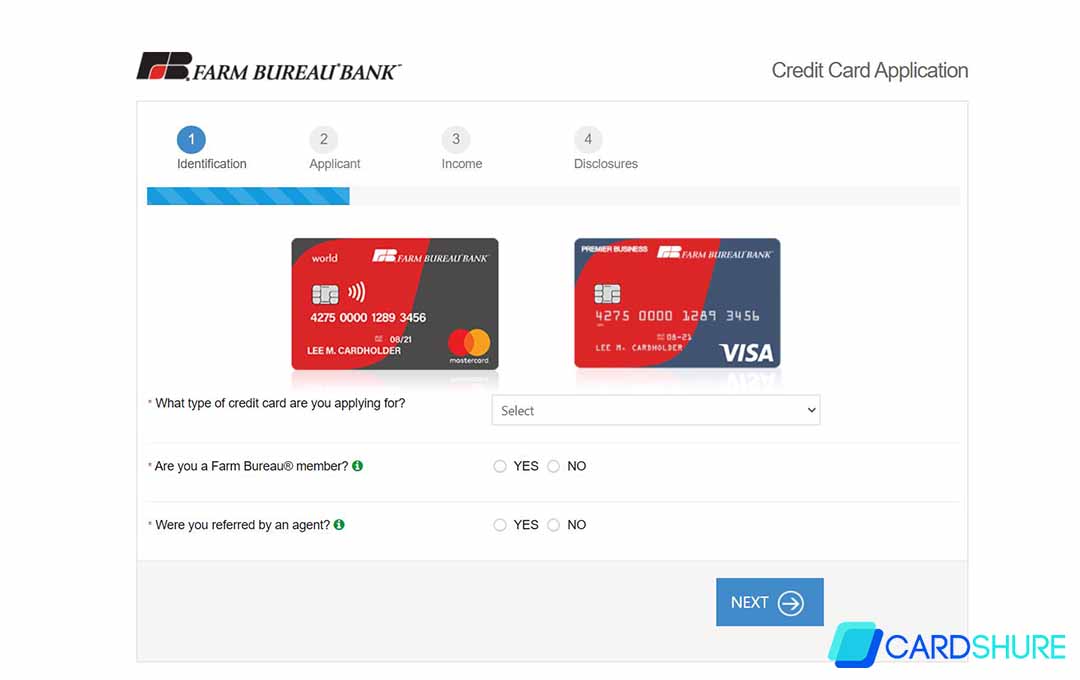

- First head to the Farm Bureau Bank’s credit card Application page farmbureaubank.com/Apply/AppCreditDev

- Then select the card that you would like to be applying for, from the pulldown menu. Indicated that you are a Farm Bureau member and if you are or are not referred by an agent.

- If unfortunately, you are not a Farm Bureau member, you would be required to apply by mail and pay about $250 application fee. If this seems to be the case, indicate that you are not a member and the dialogue pictured below would appear. If you wish to proceed, click on Apply now and then print the PDFs. You will be required to follow the prompts and complete your application by hand.

- Click next

- Then on the next page provide the following information

- Full name

- Complete physical address

- Residence type

- Time at residence

- Provide the following details required

- Mailing address (if different from your physical address)

- Phone number

- Date of birth

- SSN

- Mother’s maiden name

- Whether you would like to add a joint applicant

- Select your employment status

- If you happen to be employed, then you would be required to provide the following details

- Current position

- Employer name

- Employer name

- Employer phone #

- Your gross income

- Your income frequency

- Your length of current employment

- Your length of time in said industry

- If you are self-employed, then you will be asked to provide the details outlined below:

- Type of business

- Business name

- Business Phone #

- Complete business address

- Gross income

- Income frequency

- Length of employment

- Length of time in said industry

- If you would like to provide any extra feedback to the Farm Bureau Bank write your message on the field provided.

- Review the terms and conditions, if you agree to the terms and you would like to continue, click on submit.

With this, your application would be submitted and that is it.

Farm Bureau Member Rewards MasterCard FAQ

Is There a Fee to Use Enhanced Online Banking?

No. Farm Bureau bank members only get to enjoy free access to our enhanced online banking platform, which includes business online banking, online bill pay, FBBmobile, and FBBCardcontrols.

Can I Access My Account Using my Smartphone or Tablet?

Yes. You are able to access your account from your smartphone or tablet via the Farm Bureau Member Rewards Mastercard app. FBBmobile. Download the applications from the Apple or Google Play app store.

Why are the Numbers on My Mastercard Flat?

If you have a credit card that has a “flat” Number, you have received a Mastercard unembossed chip card. the flat numbers serve as another security feature to help you manage risk.

More Related Content

- Debit Card Visa Balance Check at www.giftcardgranny.com

- Gift Card Granny Login and Activate at www.giftcardgranny.com

- Black Hills Federal Credit Union Visa Credit Card Login @ www.bhfcu.com

- Goody’s Credit Card Login and Activation @ d.comenity.net

- Dillard’s Credit Card Application at www.dillards.com