All cardholders of the Westpac Altitude Black credit card get to manage their credit online via Login into their online account. The Online account would allow its users to make immediate payments on outstanding balances, request some extra cards, and review monthly statement history without ever having to leave their own homes.

If you need some guidance on how you can create your account or how to set one up if you have not done that already, then scroll down this page and follow the steps that we have created to properly guide you on how to log in to your online account.

Westpac Altitude Black Credit Card

The Westpac Altitude black credit card allows you to earn several bonus points via three reward programs. The Westpac Altitude Rewards, velocity frequent flyer, and Qantas Frequent flyer.

If you decide to go for Westpac’s very own loyalty program altitude rewards, you will be offered 140,000 bonus altitude points after at least spending $6,000 within 120 days of card approval. Plus, they also offer 0% p.a. on balance transfers for 24 months, which is a very big credit limit, and complimentary insurance.

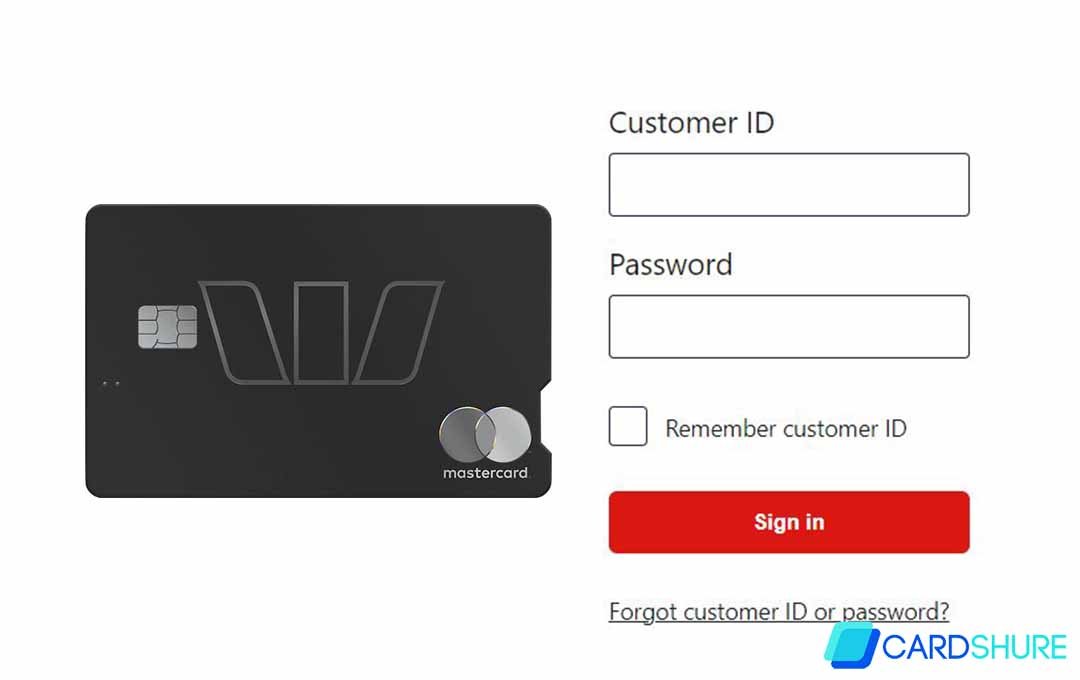

Westpac Altitude Black Credit Card Login

Below is the step-by-step guide on how to log in to your online credit card page. To kick off the login process, first head to the login homepage at https://www.westpac.com.au/

- On the page, click on the sign-in link on the page

- On the login page, enter your login credentials in the blank spaces provided, and then click on the sign icon to access the online account.

- If you do not remember your password, you can reset it by, clicking on the reset your password link and continuing on to step 4.

- In other to retrieve your Forgotten password you are expected to enter your customer ID and date of birth into the provided blank spaces.

- After that, click on the “Next” button to begin the retrieval process.

Activation

There are two major processes to activate your Westpac Altitude account, the first is by contacting their customer service, and the other one is the secure activation process that can be done via this link http://www.westpac.com.au/

If you are yet to sign up for an online account, you may do so by either calling the number listed above or enrolling online. In other to enroll online, click on the secure activation link pasted above to kick off the process:

- On the new page that pops up, click on “register now”

- After that, click on the Register Now button

- On the following page, you are expected to enter the information requested:

- Customer ID

- First name

- Last name

- Date of Birth

- Click on the “next” icon to continue the process

After this, you would be directed to create security questions, and a password and then enter some basic details concerning yourself and your account preferences before you can finalize the process for the application. Once it has been completed, you should be able to manage your credit online with ease.

Westpac Altitude Black Credit Card FAQ

How Do I Link My Westpac Card to Qantas Frequent Flyers?

First log in to the portal making use of your Qantas frequent flyer account to access your invitation, link it with an eligible Qantas flight booking, or find out more information.

Do Westpac Altitude Points Expire?

Altitude points require no expiry date as long as you are in possession of an altitude account. Once you have closed your account, you will need about 90 days to redeem your altitude points.

How Much are Westpac Altitude Points Worth?

There is no exact value for altitude reward points because the dollar value is different between rewards. But to give you an idea, redeeming Altitude rewards points for cashback offers you 0.35 cents per point.

More Related Content

- Chase Freedom Unlimited Credit Card Login at www.chase.com

- Visa and Mastercard – What Makes them Standout Among the Crowd

- How to Apply for Loft Credit Card – Requirement

- How Does Credit Card Interest Works?

- Express Credit Card Apply at www.express.com/credit-card-application